Advocacy

You’re The BEST Advocate for Your Credit Union!

Why?

Well, because you ask good questions like that, for starters ![]()

Plus, you are the one person in the whole world who really-truly understands what it’s like to live your life and how being a Credit Union Member makes it better.

And we’re not just talking about the friendly smiles and the free coffee. (Those are pretty awesome, though.) We’re talking about the feeling of investing your money in a local, cooperatively owned Credit Union and knowing that means your neighbors can borrow the money they need, when they need it.

PLUS, we’re talking about how Credit Unions all over Wisconsin, the USA, and the globe can provide the amazing benefits of being a part of the Credit Union family because our members believe in us.

So yeah, being a Member, knowing that we’re here to help, and letting your voice be heard by the lawmakers that represent you makes YOU the best advocate for what we do.

So cool, right?

Current Advocacy Issues

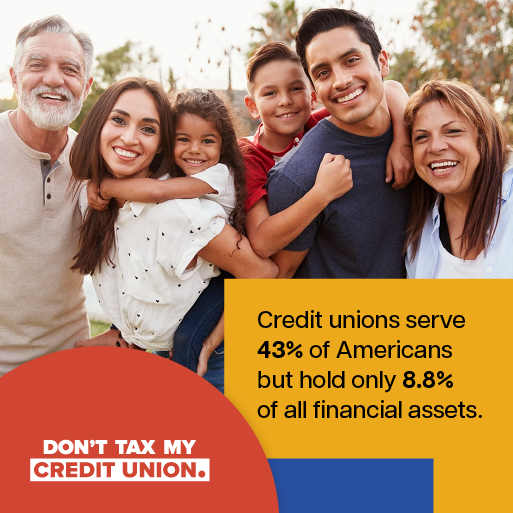

Don't Tax My Credit Union.

Credit unions exist to serve their members, not to generate profits for shareholders. That’s why they’ve been tax-exempt for nearly a century—because they reinvest earnings into better rates, lower fees, and community support. However, some lawmakers have recently discussed the idea of taxing credit unions, which could mean higher costs and fewer benefits for members like you.

While no formal bill has been introduced yet, we must stay proactive to ensure these discussions don’t gain momentum. The best way to protect credit unions is by making sure lawmakers hear directly from the people who benefit from them—you!

Why Protecting Credit Unions Matters

- A tax on credit unions is a tax on YOU. Credit unions pass their earnings back to members through lower loan rates, higher savings returns, and reduced fees. Taxing credit unions would take money out of members' pockets.

- Credit unions fuel local economies. As not-for-profit financial institutions, credit unions support small businesses, families, and community development in ways that big banks simply don’t.

- The fight isn’t new, but our voices matter. Lawmakers have questioned credit unions’ tax status before, but time and time again, advocacy from members has made the difference in stopping harmful legislation.

How You Can Help

- Stay informed – Follow updates on advocacy efforts to protect credit unions.

- Speak up – Contact your representatives and let them know that credit unions matter to you. DontTaxMyCreditUnion.org

- Spread the word – Encourage fellow credit union members to take action.

Now is the time to stand up for credit unions and the benefits they provide to you and your community. Together, we can ensure credit unions remain strong, tax-free, and member-focused.

A New IRS Proposal Could Affect Your Account

As Congress considers new infrastructure spending, lawmakers are considering unconventional sources of revenue to fund their plans. One proposal under consideration would require financial institutions like Simplicity CU to report to the Internal Revenue Service (IRS) many activities on accounts with balances over $600. Such an unprecedented grab of your personal financial data raises several concerns.

- This proposal would violate the personal privacy of consumers like you by forcing credit unions and other financial institutions to provide the government with information that does not reflect the taxable activity.

- Financial institutions—particularly those in rural and low-income communities—would face a new and expensive regulatory burden that could make it untenable to serve those consumers already left behind by Wall Street banks.

- The government relies on decades-old data systems to store and secure IRS information. These systems have already been compromised in recent years, and the addition of this type of data only increases the likelihood of a future breach of your personal financial information.

What We Need from You

At Simplicity CU, we value your voice and believe it’s our duty to keep you informed when legislation could directly affect you.

This is your chance to tell Congress to reject this new IRS reporting provision.

Click on this link to learn more and send an e-mail to your U.S. Representative today.

Make Your Voice Heard!

As YOUR not-for-profit, democratically controlled (and hopefully favorite) CU, we're proud to give you a voice in how we do what we do. Your vote matters, for real.

And that's also why we're enthusiastically supporting CreditUnionsVote.com. You see, our local, state, and national elections are a great chance to support candidates that are credit union people, just like you, and believe you deserve all of the benefits that the not-for-profit, community-focused, real-people-loving credit unions like Simplicity CU have to offer.

At CreditUnionsVote.com you can check your registration status, find out where your polling location is and what early and absentee voting options are available to you. There are a lot of different ways to vote safely and securely this year. Choose which one is right for you and vote!

Stop the Data Breaches!

We believe protecting the privacy and security of your accounts is one of the most important things we can do and we need your help to make sure the places you spend your hard earned money do the same.

When we're alerted of a data breach at a retailer - like the ones that have made national headlines at Target, Home Depot, Best Buy, or Sears - we take action immediately. We contact the affected members, work with them to change account numbers, and issue new credit and debit cards to keep their money safe.

In many cases, we can't even say which merchant caused the breach even though we're the ones working to protect your account from the fraud.

The current system is broken and needs to be fixed. That’s why we need your help! Reach out to Congress and tell them to Stop the Data Breaches!

FAAQ's (Frequently Asked Advocacy Questions)

Yes! Right. Here’s the quick low-down.

Credit Unions (Banks and some other lenders too) are pretty heavily regulated to make sure we’re all doing the right things. For example, we have to make sure that if we’re going to charge you interest on a loan, we tell you what it is and there are no scary surprises. A lot of the regulations are pretty common sense like that, and we follow them because that’s our job.

What can happen, though, is that lawmakers decide to add or change one of the regulations we have to follow in a way that doesn’t make sense for everyone. For example: some newer regulations in the Mortgage world mean so much more paperwork and red tape that a small credit union has to hire more people just to keep up. A big employer, like a national Bank, might be able to easily add the person power to while hometown Credit Union with a tight budget can’t.

To follow the regulations and avoid a hefty fine, that little Credit Union may have to raise fees or cut member benefits to make it work long term.

Follow us so far?

Perfect!

We’re not going to lie, some of our ‘Financial Cousins’ like the big national Banks, have pretty deep pockets so they can pay full time lobbyists to be there in Madison and Washington D.C. where the lawmakers hang out. Those lobbyists spend a ton of time – and money – to make sure the laws favor the people they work for.

In the Credit Union movement, our pockets are … well, your pockets. Our members own us and we’re not-for-profit. That means that when we’re spending money, we’re spending YOUR money, and we have to make sure we’re investing it in things that help you now, right?

Instead of a huge team of high-paid lobbyists Credit Unions work together with our members to make sure your money is protected, and your voice is heard.

Sure! There’s a lot in it for you, but let’s be really honest and talk money.

According to a study published by TruStage, unnecessary regulations cost Wisconsin Credit Union members an average of $116 each.

No, it’s not a TON of money, but it does come out to a total of $167 Million in our state alone, and that’s a lot of money that could be back in our communities – and your pockets – to make the world better, right?

So, by spending a little time to advocate for common sense regulations, you stand to save $116 for every Credit Union member in your household. It adds up, right?

Fair. If we’re going to ask you to talk the talk, we better be right there with you.

At Simplicity CU we believe that advocacy is a vital part of what we do. Those are nice words, right? How about we back them up?

We’re a part of a group of Credit Unions across the USA that work with TruStage to make sure our members know what lawmakers are doing about regulation changes that would affect us all. We’re trying to get the tools in your hands to reach your representatives and tell them how you feel.

Tools like CommonSenseRegulations.com where you can learn more, take action, and share your own story.

We also make sure to show up at events like the State and National Government Affairs Conferences every year. There we can get in the room with the lawmakers, talk to them like people (which they are), and help them understand what you need to be a happy, healthy Credit Union member.

(We made this video State GAC to help you learn more about it, too.)

Let’s do this! Start with these three easy steps:

Jump over to www.commonsenseregulations.com where you’ll find handy links to help you reach out to your lawmakers on all of the most current CU Advocacy issues.

Follow Simplicity CU and TruStage on social media to stay in-the-know and share the issues that matter to you most with your friends and family.

Be smart. Be Loud. Never stop.

Let’s make a deal, ok? Now that you’ve found our Advocacy page, keep it in mind. Whenever there’s something we think you’ll want to know it’ll live on this page so you can always check back in and see what’s up.

You can also keep reading below and see some of the really, truly awesome things Credit Unions and their members have accomplished together. Spoilers: It’s gone on a lot longer than you realize!